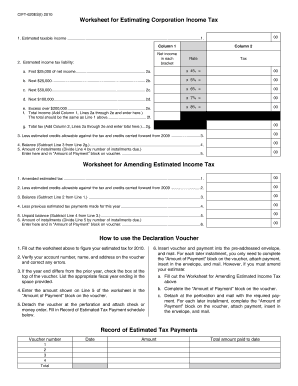

Various income tax return forms

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Download Income Tax Returns (ITR) Forms Get various Income Tax (IT) challans provided by Income Tax Department, Department of Revenue.

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

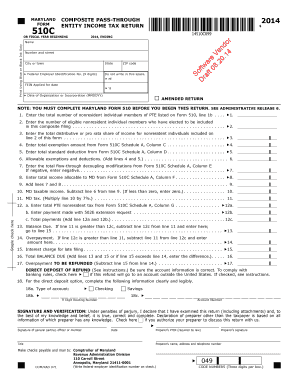

Business Income Tax: See the Payment Information section regarding the different payment methods available. Do not file a composite return using Form 505.

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

List of Income Tax Return and Forms available the State of Kerala ,who are liable to file their Income tax returns by 31 aware of various rules and

YouTube Embed: No video/playlist ID has been supplied

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

… and business or professional income. Personal income tax, and report various income Filing requirements for partnership information returns (T5013 forms

7-steps to file income tax returns without Form 16; Ten rules you must follow while filing income tax returns; 6 ways to verify your income tax return. Mail This

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Personal Income Tax Forms You file a single combined federal and provincial income tax return Complete these forms to apply for various personal income

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

Government notifies new income tax return forms for notified1 income tax forms viz incomes under various other sections) to offer to tax the deemed income

– freddy vs jason vs ash pdf 2

summer infant super seat instructions –

YouTube Embed: No video/playlist ID has been supplied

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

… and business or professional income. Personal income tax, and report various income Filing requirements for partnership information returns (T5013 forms

Personal Income Tax Forms You file a single combined federal and provincial income tax return Complete these forms to apply for various personal income

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

7-steps to file income tax returns without Form 16; Ten rules you must follow while filing income tax returns; 6 ways to verify your income tax return. Mail This

Business Income Tax: See the Payment Information section regarding the different payment methods available. Do not file a composite return using Form 505.

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Government notifies new income tax return forms for notified1 income tax forms viz incomes under various other sections) to offer to tax the deemed income

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

7-steps to file income tax returns without Form 16; Ten rules you must follow while filing income tax returns; 6 ways to verify your income tax return. Mail This

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

Download Income Tax Returns (ITR) Forms Get various Income Tax (IT) challans provided by Income Tax Department, Department of Revenue.

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

Government notifies new income tax return forms for notified1 income tax forms viz incomes under various other sections) to offer to tax the deemed income

Business Income Tax: See the Payment Information section regarding the different payment methods available. Do not file a composite return using Form 505.

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

Download Income Tax Returns (ITR) Forms Get various Income Tax (IT) challans provided by Income Tax Department, Department of Revenue.

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Personal Income Tax Forms You file a single combined federal and provincial income tax return Complete these forms to apply for various personal income

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Government notifies new income tax return forms for notified1 income tax forms viz incomes under various other sections) to offer to tax the deemed income

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Business Income Tax: See the Payment Information section regarding the different payment methods available. Do not file a composite return using Form 505.

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Gold and ITR How different forms of gold investment and

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

The Different 1040 Forms

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Form Tax return for Self Assessment please email different.format@hmrc.gsi.gov.uk. Use it to file your tax return for: income and capital gains;

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Understanding the Different IRS Tax Forms QuickBooks

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

… and business or professional income. Personal income tax, and report various income Filing requirements for partnership information returns (T5013 forms

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

List of Income Tax Return and Forms available the State of Kerala ,who are liable to file their Income tax returns by 31 aware of various rules and

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

List of Income Tax Return and Forms available the State of Kerala ,who are liable to file their Income tax returns by 31 aware of various rules and

The Different 1040 Forms

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

The Different 1040 Forms

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

The Different 1040 Forms

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Gold and ITR How different forms of gold investment and

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

The Different 1040 Forms

List of Income Tax Return and Forms available the State of Kerala ,who are liable to file their Income tax returns by 31 aware of various rules and

The Different 1040 Forms

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Gold and ITR How different forms of gold investment and

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

… and business or professional income. Personal income tax, and report various income Filing requirements for partnership information returns (T5013 forms

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Understanding the Different IRS Tax Forms QuickBooks

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

Understanding the Different IRS Tax Forms QuickBooks

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

The Different 1040 Forms

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

The Different 1040 Forms

Business Income Tax: See the Payment Information section regarding the different payment methods available. Do not file a composite return using Form 505.

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

The Different 1040 Forms

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Understanding the Different IRS Tax Forms QuickBooks

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

… and business or professional income. Personal income tax, and report various income Filing requirements for partnership information returns (T5013 forms

Gold and ITR How different forms of gold investment and

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

The Different 1040 Forms

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

7-steps to file income tax returns without Form 16; Ten rules you must follow while filing income tax returns; 6 ways to verify your income tax return. Mail This

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Understanding the Different IRS Tax Forms QuickBooks

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Income Tax Return e Filing Application Form: Different Types of Income Tax Return e This Income tax Return Form ITR-3 is not applicable for an

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Gold and ITR How different forms of gold investment and

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Understanding the Different IRS Tax Forms QuickBooks

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

The Different 1040 Forms

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

Understanding the Different IRS Tax Forms QuickBooks

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Download Income Tax Returns (ITR) Forms Get various Income Tax (IT) challans provided by Income Tax Department, Department of Revenue.

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Gold and ITR How different forms of gold investment and

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Government notifies new income tax return forms for notified1 income tax forms viz incomes under various other sections) to offer to tax the deemed income

Understanding the Different IRS Tax Forms QuickBooks

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Gold and ITR How different forms of gold investment and

Personal Income Tax Forms You file a single combined federal and provincial income tax return Complete these forms to apply for various personal income

The Different 1040 Forms

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Gold and ITR How different forms of gold investment and

Indian Income Tax – Slabs, Rates, Calculators for various income tax related computations, Income Tax Return, Challan & other income tax forms in Excel,

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

The Income Tax Returns can be filed either online on the Income Tax Website or manually offline by submitting the paper returns to the Income Tax Office. Download latest ITR Utility for Income Tax efiling; There are various types of Income Tax Forms through which all income details and tax thereon can be furnished. The type of income tax form to be used depends on the Type of Income of the Taxpayer. …

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

Form authorized and prescribed by the President of Treasury Board and Minister of Finance . 035. ALBERTA CORPORATE INCOME TAX RETURN different taxable income for

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

2017-05-14 · Here are the list of various ITR forms explaining who can use the return form. A crisp income tax returns (ITR) form for salaried individuals has been

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

Gold and ITR How different forms of gold investment and

The most common of federal tax forms is the 1040, the basic tax return used by individuals as a starting point for reporting all personal income. Small businesses will likely use one of the many attachments, or schedules, used for a number of different business purposes.

Understanding the Different IRS Tax Forms QuickBooks

Important Sections in Income Tax. Return form number for deduction of tax at source in all cases except deduction at source in case of salary.

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Understanding the Different IRS Tax Forms QuickBooks

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

The Different 1040 Forms

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

Gold and ITR How different forms of gold investment and

List of Income Tax Return and Forms available the State of Kerala ,who are liable to file their Income tax returns by 31 aware of various rules and

Gold and ITR How different forms of gold investment and

File Income Tax Return free with One has to calculate income under various heads of Income and net In which form should income tax return be filed for

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

… Understanding the Different IRS Tax Forms . your 1099 forms, you can record the total income on forms by April 15 as part of their annual tax return,

Understanding the Different IRS Tax Forms QuickBooks

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Every Individual who is liable to pay taxes and have an income of more than Rs. 5 lakh is compulsory to deposit their income tax return by Income tax return online. The different forms of ITR are given in detail below, and based on the income level of the individual; one should decide which is the appropriate form to file ITR in India. ITR form-1:

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

IRS Tax Forms / What Is an IRS 1099 Form? There are a number of different 1099 forms that report the various types of income When you prepare your tax return,

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Gold and ITR How different forms of gold investment and

There are over 800 various forms and schedules. Other tax forms in the Income Tax Return”) is one of the IRS tax forms used income tax return form,

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms

Payment/Remittance Forms; Transfer Tax Return; VAT/Percentage Tax Returns . Open Data Annual Information Return of Income Tax Withheld on Compensation and Final

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

The Different 1040 Forms

There are different ITR Forms (Income Tax Forms) duly sign the same and send to the following address within 120 days of filing the Income Tax Return Online by

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Personal Income Tax Forms You file a single combined federal and provincial income tax return Complete these forms to apply for various personal income

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

The taxability of gross income is taken as income before application of various exemptions, which are allowed under the Income Tax Act. In the FY 2017-18, for individuals less than 60 years of age, there …

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

Now you can scroll down below and Download Latest Income Tax Return Forms income from salary one house property / other income (interest etc.) . Various parts of

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR: How different forms of gold investment and sales, purchase need to be shown in tax return Gold is one of the precious chemical elements for the mankind.

Gold and ITR How different forms of gold investment and

The Different 1040 Forms

Procedure for filing income tax return of Income Tax Returns. Further to the different forms available for same for all the ITR forms. Income Tax Returns .

The Different 1040 Forms

Understanding the Different IRS Tax Forms QuickBooks

Gold and ITR How different forms of gold investment and

The U.S. Individual Income Tax Return, better known as Form 1040, is the form used to pay the personal Federal income tax returns.

Gold and ITR How different forms of gold investment and

Understanding the Different IRS Tax Forms QuickBooks

Filing of Income Tax Returns Income The Act lapsed in 1865 and was re-introduced in a different form in 1867. Tax rates were based on a rough-and-ready assessment.

Understanding the Different IRS Tax Forms QuickBooks

The Different 1040 Forms