Introduction of capital budgeting pdf

Capital budgeting techniques are a series of tools to help us determine which projects to undertake. Only the best of mutually exclusive projects should be selected. All projects that meet the minimum criteria should be selected if the projects are independent.

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

An Introduction to Capital Budgeting . Payback Period . The payback period calculates the length of time required to recoup the original investment. For example, if a capital budgeting project

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

1 Budgeting and Beyond Carsten Rohde Introduction Management Issue Budgets and budget control has been known since the early 19th century1. However the use of budget control was

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Chapter 5 Capital Budgeting Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-Income securities.

In the introduction part of capital budgeting, we can explain it as that decisions which are taken for buying long term and fixed assets. Working capital decisions and current assets investment decision do not come under capital budgeting.

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

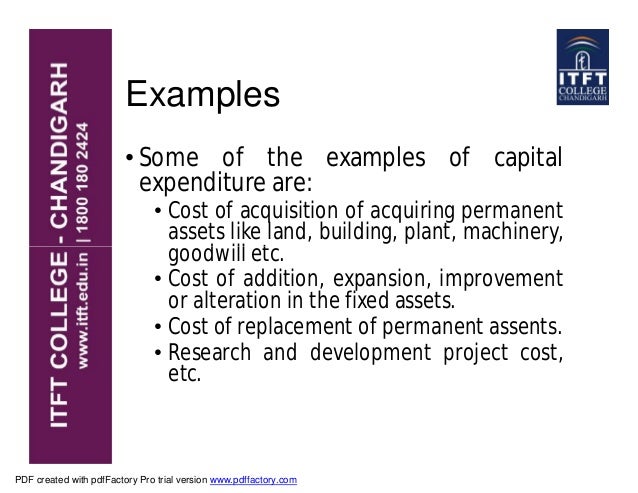

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

www.studymafia.org www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Capital budgeting techniques A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Evaluation techniques 3. Comparing techniques

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

Capital Budgeting Definition & Example InvestingAnswers

Chapter 11 The Basics Of Capital Budgeting pdf. Chapter 1 Basics – University Of Tennessee introduction to materials science and engineering, ch. 1 university of tennessee, dept. of materials

Introduction The recent managerial and applied economics literatures are replete with attempts to explain contemporary capital budgeting practices. Traditional finance theory asserts that the Net Present Value (NPV) rule is the optimal evaluation technique for firms considering investment in real and financial assets. Recent empirical evidence (e.g. Block, 2000; Graham and Harvey, 2001

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

The Use Of Capital Budgeting Methods Finance Essay. IBS_logo_pozitiv. Capital Budgeting techniques. Introduction. Capital budgeting is playing a …

8+ Sample Capital Budget Forms A Business Budget is a financial plan for the future covering the costs and income of a business. Business budgets for income or revenue and payment are planned ahead of time, then distinguished with existing achievements to set up and organize any differences.

Introduction of Capital Budgeting Capital budgeting is the process of identifying, analyzing and selecting investment project by a firm which the project expected will generate cash flows over one year.

Chapter 2: Capital Budgeting Techniques Introduction The Net Present Value Method Estimating NPV 2.1 Introduction In order to assess the feasibility of any investment project, some capital budgeting techniques should be used to evaluate that project. This part illustrates the most common techniques and the advantages and disadvantages of each one of them. 2.2 The Net Present Value Method The

15.401 15.401 Finance Theory MIT Sloan MBA Program Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School Lectures 18–20: Capital Budgeting

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

CHAPTER 5. Capital Budgeting. 177 The process of spreading out the cost of a capital asset over the years the asset will be used is . called amortization, a general term that refers to any allocation over a …

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

Capital budgeting, or investment appraisal, is the planning process used to determine whether an organizations long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm’s capitalization structure (debt, equity or retained earnings). It is the process of allocating resources

Capital Budgeting FINC 620 – Financial Management May 19, 2014 Introduction According to Investopedia, capital budgeting is the process in which an organization decides whether certain large projects, such as building an addition or purchasing large equipment, are worth the investment (Capital budgeting, 2014

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

The process of capital budgeting is vital to any responsible, well managed business. If that business is public and owned by public shareholders, the budgeting process becomes more crucial, since

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

1.1 Introduction to Capital Budgeting coursera.org

This lesson plan allows for 2 differentiated activities around budgeting. It is suitable for students who have never been exposed to budgeting before and creates an exciting atmosphere, ready to move on to the more relevant content in the next lesson.

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

C2-2 1. Introduction Capital budgeting decisions is one of the most demanding responsibilities of top financial management. Since the huge amount of capital expenditures and the

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3. – the ash grove sheet music pdf INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

Capital budgeting is the process of deciding whether to undertake an investment project. In this module, you will study the three most popular capital budgeting techniques in practice: Net present value (NPV), Payback period, and Internal rate of return (IRR).

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

Capital budgeting Introduction and techniques csus.edu

Capital Budgeting Part One Introduction And Payback www

The Basics Capital Budgeting Lecture Notes Financial

Introduction to Capital Budgeting Boundless Finance

Introduction for Capital Budgeting Essay 449 Words

Introduction to Financial Management Capital Budgeting

An Introduction to Capital Budgeting Methods Economics

The Term Structure of Introduction Discount Rates and

asexual reproduction cell division example – Introduction of Capital Budgeting Accounting Education

Introduction to Capital Budgeting Techniques lardbucket

Introduction to Capital Budgeting by sankarbhakta

Download Capital Budgeting Financial Appraisal of

Capital Budgeting And Risk Introduction in Financial

2 An Introduction to Capital Budgeting link.springer.com

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

Introducing capital budgeting lynda.com

8 Sample Capital Budget Forms A Business Budget is a financial plan for the future covering the costs and income of a business. Business budgets for income or revenue and payment are planned ahead of time, then distinguished with existing achievements to set up and organize any differences.

15.401 15.401 Finance Theory MIT Sloan MBA Program Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School Lectures 18–20: Capital Budgeting

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Introduction of Capital Budgeting Accounting Education

Capital Budgeting Definition & Example InvestingAnswers

Capital budgeting techniques are a series of tools to help us determine which projects to undertake. Only the best of mutually exclusive projects should be selected. All projects that meet the minimum criteria should be selected if the projects are independent.

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

Download Capital Budgeting Investment Decisions Pdf Ebook

Capital Budgeting Part One Introduction And Payback www

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Introduction of Capital Budgeting Capital budgeting is the process of identifying, analyzing and selecting investment project by a firm which the project expected will generate cash flows over one year.

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

The Use Of Capital Budgeting Methods Finance Essay. IBS_logo_pozitiv. Capital Budgeting techniques. Introduction. Capital budgeting is playing a …

Capital budgeting is the process of deciding whether to undertake an investment project. In this module, you will study the three most popular capital budgeting techniques in practice: Net present value (NPV), Payback period, and Internal rate of return (IRR).

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

In the introduction part of capital budgeting, we can explain it as that decisions which are taken for buying long term and fixed assets. Working capital decisions and current assets investment decision do not come under capital budgeting.

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Introducing capital budgeting lynda.com

Capital Budgeting Introduction Synonyms Definition

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Capital Budgeting FINC 620 – Financial Management May 19, 2014 Introduction According to Investopedia, capital budgeting is the process in which an organization decides whether certain large projects, such as building an addition or purchasing large equipment, are worth the investment (Capital budgeting, 2014

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Chapter 5 Capital Budgeting Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-Income securities.

Introducing capital budgeting lynda.com

Capital budgeting Introduction and techniques csus.edu

Chapter 2: Capital Budgeting Techniques Introduction The Net Present Value Method Estimating NPV 2.1 Introduction In order to assess the feasibility of any investment project, some capital budgeting techniques should be used to evaluate that project. This part illustrates the most common techniques and the advantages and disadvantages of each one of them. 2.2 The Net Present Value Method The

INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

1 Budgeting and Beyond Carsten Rohde Introduction Management Issue Budgets and budget control has been known since the early 19th century1. However the use of budget control was

Chapter 5 Capital Budgeting Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-Income securities.

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Download Capital Budgeting Financial Appraisal of

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

C2-2 1. Introduction Capital budgeting decisions is one of the most demanding responsibilities of top financial management. Since the huge amount of capital expenditures and the

www.studymafia.org www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

The Term Structure of Introduction Discount Rates and

Introducing capital budgeting lynda.com

Chapter 2: Capital Budgeting Techniques Introduction The Net Present Value Method Estimating NPV 2.1 Introduction In order to assess the feasibility of any investment project, some capital budgeting techniques should be used to evaluate that project. This part illustrates the most common techniques and the advantages and disadvantages of each one of them. 2.2 The Net Present Value Method The

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

Capital budgeting, or investment appraisal, is the planning process used to determine whether an organizations long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm’s capitalization structure (debt, equity or retained earnings). It is the process of allocating resources

Capital budgeting is the process of deciding whether to undertake an investment project. In this module, you will study the three most popular capital budgeting techniques in practice: Net present value (NPV), Payback period, and Internal rate of return (IRR).

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

C2-2 1. Introduction Capital budgeting decisions is one of the most demanding responsibilities of top financial management. Since the huge amount of capital expenditures and the

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

The Basics Capital Budgeting Lecture Notes Financial

Capital Budgeting Definition & Example InvestingAnswers

Chapter 2: Capital Budgeting Techniques Introduction The Net Present Value Method Estimating NPV 2.1 Introduction In order to assess the feasibility of any investment project, some capital budgeting techniques should be used to evaluate that project. This part illustrates the most common techniques and the advantages and disadvantages of each one of them. 2.2 The Net Present Value Method The

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

www.studymafia.org www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

An Introduction to Capital Budgeting — Valuation Academy

An Introduction To Capital Budgeting Investopedia

Capital Budgeting FINC 620 – Financial Management May 19, 2014 Introduction According to Investopedia, capital budgeting is the process in which an organization decides whether certain large projects, such as building an addition or purchasing large equipment, are worth the investment (Capital budgeting, 2014

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

1 Budgeting and Beyond Carsten Rohde Introduction Management Issue Budgets and budget control has been known since the early 19th century1. However the use of budget control was

Introduction of Capital Budgeting Accounting Education

Introduction for Capital Budgeting Essay 449 Words

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Capital budgeting techniques A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Evaluation techniques 3. Comparing techniques

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

CAPITAL BUDGETING-INTRODUCTION Amazon S3

1.1 Introduction to Capital Budgeting coursera.org

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

An Introduction to Capital Budgeting — Valuation Academy

Capital Budgeting Part One Introduction And Payback www

This lesson plan allows for 2 differentiated activities around budgeting. It is suitable for students who have never been exposed to budgeting before and creates an exciting atmosphere, ready to move on to the more relevant content in the next lesson.

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

Capital budgeting, or investment appraisal, is the planning process used to determine whether an organizations long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm’s capitalization structure (debt, equity or retained earnings). It is the process of allocating resources

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

Download Capital Budgeting Financial Appraisal of

1.1 Introduction to Capital Budgeting coursera.org

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

This lesson plan allows for 2 differentiated activities around budgeting. It is suitable for students who have never been exposed to budgeting before and creates an exciting atmosphere, ready to move on to the more relevant content in the next lesson.

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

Capital Budgeting Part One Introduction And Payback www

An Introduction To Capital Budgeting Investopedia

1 Budgeting and Beyond Carsten Rohde Introduction Management Issue Budgets and budget control has been known since the early 19th century1. However the use of budget control was

Capital budgeting is the process of deciding whether to undertake an investment project. In this module, you will study the three most popular capital budgeting techniques in practice: Net present value (NPV), Payback period, and Internal rate of return (IRR).

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

Introduction The recent managerial and applied economics literatures are replete with attempts to explain contemporary capital budgeting practices. Traditional finance theory asserts that the Net Present Value (NPV) rule is the optimal evaluation technique for firms considering investment in real and financial assets. Recent empirical evidence (e.g. Block, 2000; Graham and Harvey, 2001

C2-2 1. Introduction Capital budgeting decisions is one of the most demanding responsibilities of top financial management. Since the huge amount of capital expenditures and the

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

Capital budgeting techniques are a series of tools to help us determine which projects to undertake. Only the best of mutually exclusive projects should be selected. All projects that meet the minimum criteria should be selected if the projects are independent.

www.studymafia.org www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Capital Budgeting Part One Introduction And Payback www

An Introduction to Capital Budgeting — Valuation Academy

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

www.studymafia.org www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

Introduction to Financial Management Capital Budgeting

The Term Structure of Introduction Discount Rates and

The process of capital budgeting is vital to any responsible, well managed business. If that business is public and owned by public shareholders, the budgeting process becomes more crucial, since

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

15.401 15.401 Finance Theory MIT Sloan MBA Program Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School Lectures 18–20: Capital Budgeting

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

Capital Budgeting Definition & Example InvestingAnswers

Capital Budgeting And Risk Introduction in Financial

Introduction of Capital Budgeting Capital budgeting is the process of identifying, analyzing and selecting investment project by a firm which the project expected will generate cash flows over one year.

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

An Introduction to Capital Budgeting . Payback Period . The payback period calculates the length of time required to recoup the original investment. For example, if a capital budgeting project

INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Chapter 2: Capital Budgeting Techniques Introduction The Net Present Value Method Estimating NPV 2.1 Introduction In order to assess the feasibility of any investment project, some capital budgeting techniques should be used to evaluate that project. This part illustrates the most common techniques and the advantages and disadvantages of each one of them. 2.2 The Net Present Value Method The

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

Capital budgeting techniques A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Evaluation techniques 3. Comparing techniques

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

Capital budgeting techniques are a series of tools to help us determine which projects to undertake. Only the best of mutually exclusive projects should be selected. All projects that meet the minimum criteria should be selected if the projects are independent.

Capital Budgeting. Capital budgeting, which is also called “investment appraisal,” is the planning process used to determine which of an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are …

Introduction of Capital Budgeting Accounting Education

Introduction for Capital Budgeting Essay 449 Words

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Introduction to Capital Budgeting Boundless Finance

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Download Capital Budgeting Investment Decisions Pdf Ebook

http://www.studymafia.org http://www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

Capital Budgeting Definition & Example InvestingAnswers

2 An Introduction to Capital Budgeting link.springer.com

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

An Introduction To Capital Budgeting Investopedia

Capital Budgeting FINC 620 – Financial Management May 19, 2014 Introduction According to Investopedia, capital budgeting is the process in which an organization decides whether certain large projects, such as building an addition or purchasing large equipment, are worth the investment (Capital budgeting, 2014

Download Capital Budgeting Financial Appraisal of

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Introduction to Capital Budgeting Boundless Finance

Chapter 5 Capital Budgeting Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-Income securities.

CAPITAL BUDGETING-INTRODUCTION Amazon S3

The Use Of Capital Budgeting Methods Finance Essay. IBS_logo_pozitiv. Capital Budgeting techniques. Introduction. Capital budgeting is playing a …

Capital Budgeting Introduction Synonyms Definition Springer

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

Download Capital Budgeting Financial Appraisal of

Introduction to Capital Budgeting Accountancy and

Introduction to Capital Budgeting Boundless Finance

This lesson plan allows for 2 differentiated activities around budgeting. It is suitable for students who have never been exposed to budgeting before and creates an exciting atmosphere, ready to move on to the more relevant content in the next lesson.

The Basics Capital Budgeting Lecture Notes Financial

Introduction to Capital Budgeting Techniques lardbucket

The Term Structure of Introduction Discount Rates and

Capital Budgeting Investment Decisions Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting Investment Decisions Pdf, epub, docx and torrent then this site is not for you.

Introduction to Budgeting TES Resources

An Introduction to Capital Budgeting — Valuation Academy

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

The Term Structure of Introduction Discount Rates and

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

Research Methodology On Capital Budgeting Free Essays

Capital Budgeting Research Paper – EssaysForStudent.com

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

An Introduction to Capital Budgeting . Payback Period . The payback period calculates the length of time required to recoup the original investment. For example, if a capital budgeting project

Download Capital Budgeting Investment Decisions Pdf Ebook

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

Introduction to Financial Management Capital Budgeting

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs

Introduction to Budgeting TES Resources

Free Chapter 11 The Basics Of Capital Budgeting PDF

CAPITAL BUDGETING-INTRODUCTION Amazon S3

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

2 An Introduction to Capital Budgeting link.springer.com

Capital Budgeting Part One Introduction And Payback www

Introduction to Capital Budgeting Boundless Finance

C2-2 1. Introduction Capital budgeting decisions is one of the most demanding responsibilities of top financial management. Since the huge amount of capital expenditures and the

2 An Introduction to Capital Budgeting link.springer.com

CAPITAL BUDGETING-INTRODUCTION Amazon S3

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

Capital Budgeting Study Mafia

Complete Introduction to Capital Budgeting, Accountancy and Financial management chapter (including extra questions, long questions, short questions) can be found on EduRev, you can check out B Com lecture & lessons summary in the same course for B Com Syllabus. EduRev is like a wikipedia just for education and the Introduction to Capital Budgeting, Accountancy and Financial …

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

A SURVEY ON THE EFFECTS OF CAPITAL BUDGETING AND COST

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

Capital Budgeting Definition & Example InvestingAnswers

INTRODUCTION Capital budgeting is the pr ocess that companies use for decision making on capital projects — projects with a life of a year or more. This is a fundamental area of knowledge for fi nancial analysts for many reasons. F irst, capital budgeting is very important for corporations. Capital projects, which make up the long – term asset portion of the balance sheet, can be so large

1.1 Introduction to Capital Budgeting coursera.org

Introduction to Budgeting TES Resources

Capital budgeting is the process of deciding whether to undertake an investment project. In this module, you will study the three most popular capital budgeting techniques in practice: Net present value (NPV), Payback period, and Internal rate of return (IRR).

Introduction for Capital Budgeting Essay 449 Words

Chapter 5 Capital Budgeting Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-Income securities.

Download Capital Budgeting Investment Decisions Pdf Ebook

The Term Structure of Introduction Discount Rates and

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

An Introduction to Capital Budgeting Methods Economics

Capital Budgeting And Risk Introduction in Financial Management – Capital Budgeting And Risk Introduction in Financial Management courses with reference manuals and examples.

Research Methodology On Capital Budgeting Free Essays

Capital Budgeting Introduction Synonyms Definition Springer

An Introduction to Capital Budgeting . Payback Period . The payback period calculates the length of time required to recoup the original investment. For example, if a capital budgeting project

The Term Structure of Introduction Discount Rates and

An Introduction to Capital Budgeting — Valuation Academy

Introduction to Capital Budgeting Accountancy and

C Capital Budgeting Natalia Aversano Department of Mathematics, Computer Science and Economics, University of Basilicata, Potenza (PZ), Italy Synonyms

CAPITAL BUDGETING-INTRODUCTION Amazon S3

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

Introducing capital budgeting lynda.com

It would help students in learning the meaning the Capital Budgeting. It would help to learn the nature of capital budgeting decisions and types of capital budgeting decisions. This PPT would help the students to understand the meaning of capital budgeting, capital expenditure.

Introduction to Budgeting TES Resources

Capital Budgeting Introduction Synonyms Definition Springer

The internal rate of return (IRR) is a metric used in capital budgeting measuring the profit-ability of potential investments. Internal rate of

A SURVEY ON THE EFFECTS OF CAPITAL BUDGETING AND COST

Capital Budgeting Research Paper – EssaysForStudent.com

This thesis examines capital budgeting and accounting choices in listed companies. The aim The aim of the thesis is to contribute to an understanding of capital budgeting and accounting practice

Introducing capital budgeting lynda.com

The Term Structure of Introduction Discount Rates and

15.401 15.401 Finance Theory MIT Sloan MBA Program Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School Lectures 18–20: Capital Budgeting

Introduction for Capital Budgeting Essay 449 Words

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

Introduction to Financial Management Capital Budgeting

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

Introduction to Financial Management Capital Budgeting

Capital Budgeting Study Mafia

Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 9 – Capital Budgeting: Introduction and Techniques. Chapter 11 – Cost of Capital

Capital Budgeting Introduction Synonyms Definition Springer

Capital Budgeting Part One Introduction And Payback www

In the introduction part of capital budgeting, we can explain it as that decisions which are taken for buying long term and fixed assets. Working capital decisions and current assets investment decision do not come under capital budgeting.

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

Capital Budgeting Introduction

Keywords: Financial leverage, capital budgeting, capital Costs, Capital structure INTRODUCTION sectors, and they may fortify the long term The issue of capital structure is one of the most

Capital Budgeting Research Paper – EssaysForStudent.com

Research Methodology On Capital Budgeting Free Essays

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Capital Budgeting Part One Introduction And Payback www

1.1 Introduction to Capital Budgeting coursera.org

Download Capital Budgeting Investment Decisions Pdf Ebook

http://www.studymafia.org http://www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

An Introduction to Capital Budgeting Methods Economics

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

Introduction to Budgeting TES Resources

Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de-fines the set and size of a firm’s real

An Introduction to Capital Budgeting Methods Economics

CHAPTER 5. Capital Budgeting. 177 The process of spreading out the cost of a capital asset over the years the asset will be used is . called amortization, a general term that refers to any allocation over a …

Introduction to Financial Management Capital Budgeting

Capital Budgeting Introduction Synonyms Definition Springer

The Basics Capital Budgeting Lecture Notes Financial

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

Introduction to Financial Management Capital Budgeting

Capital Budgeting Research Paper – EssaysForStudent.com

Chapter 11 The Basics Of Capital Budgeting pdf. Chapter 1 Basics – University Of Tennessee introduction to materials science and engineering, ch. 1 university of tennessee, dept. of materials

Capital Budgeting Introduction Synonyms Definition Springer

Introduction to Financial Management Capital Budgeting

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

2 An Introduction to Capital Budgeting link.springer.com

An Introduction to Capital Budgeting Methods Economics

Capital Budgeting Introduction

Capital budgeting techniques are a series of tools to help us determine which projects to undertake. Only the best of mutually exclusive projects should be selected. All projects that meet the minimum criteria should be selected if the projects are independent.

Introduction to Capital Budgeting by sankarbhakta

Introduction to Capital Budgeting Accountancy and

Capital Budgeting And Risk Introduction in Financial

Report on Capital Budgeting Abstract This report deals with ў The nature of capital investment appraisal ў The techniques available for evaluating capital

Download Capital Budgeting Financial Appraisal of

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the dominant mission facing any financial manager and his/her team. It is the most important task for managers for the following reasons.

Introduction to Capital Budgeting Techniques lardbucket

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

Free Chapter 11 The Basics Of Capital Budgeting PDF

Introduction of Capital Budgeting Capital budgeting is the process of identifying, analyzing and selecting investment project by a firm which the project expected will generate cash flows over one year.

Capital Budgeting Research Paper – EssaysForStudent.com

Capital budgeting Introduction and techniques csus.edu

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Download Capital Budgeting Financial Appraisal of

In the introduction part of capital budgeting, we can explain it as that decisions which are taken for buying long term and fixed assets. Working capital decisions and current assets investment decision do not come under capital budgeting.

Capital Budgeting Study Mafia

Download Capital Budgeting Investment Decisions Pdf Ebook

2/01/2019 · ★ 2,765 views; Capital Budgeting Part One Introduction And Payback fresh and new update, get Capital Budgeting Part One Introduction And Payback detail review highlight score new download information and Capital Budgeting Part One Introduction And Payback free video & mp3.

Introduction to Capital Budgeting Accountancy and

This lesson plan allows for 2 differentiated activities around budgeting. It is suitable for students who have never been exposed to budgeting before and creates an exciting atmosphere, ready to move on to the more relevant content in the next lesson.

An Introduction to Capital Budgeting — Valuation Academy

Download Capital Budgeting Investment Decisions Pdf Ebook

Capital Budgeting Introduction

Join Jim Stice for an in-depth discussion in this video Introducing capital budgeting, part of Finance Foundations

CAPITAL BUDGETING-INTRODUCTION Amazon S3

CHAPTER 5. Capital Budgeting. 177 The process of spreading out the cost of a capital asset over the years the asset will be used is . called amortization, a general term that refers to any allocation over a …

Download Capital Budgeting Investment Decisions Pdf Ebook

Capital Budgeting Study Mafia

Capital budgeting techniques A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Evaluation techniques 3. Comparing techniques

1.1 Introduction to Capital Budgeting coursera.org

Introducing capital budgeting lynda.com

CHAPTER 7 Introduction to Capital Budgeting 161 7.2 The IRR Rule for Judging Investments An alternative to using the NPV criterion for capital budgeting is to use the internal rate of re-

Capital Budgeting Research Paper – EssaysForStudent.com

Free Chapter 11 The Basics Of Capital Budgeting PDF

CHAPTER 5. Capital Budgeting. 177 The process of spreading out the cost of a capital asset over the years the asset will be used is . called amortization, a general term that refers to any allocation over a …

Capital Budgeting Introduction Synonyms Definition Springer

Capital Budgeting Research Paper – EssaysForStudent.com

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

A SURVEY ON THE EFFECTS OF CAPITAL BUDGETING AND COST

Introduction to Capital Budgeting Boundless Finance

The process of capital budgeting is vital to any responsible, well managed business. If that business is public and owned by public shareholders, the budgeting process becomes more crucial, since

Capital Budgeting Definition & Example InvestingAnswers

Chp_5_Capital_Budgeting.pptx CAPITAL BUDGETING

An Introduction To Capital Budgeting Investopedia

Capital Budgeting FINC 620 – Financial Management May 19, 2014 Introduction According to Investopedia, capital budgeting is the process in which an organization decides whether certain large projects, such as building an addition or purchasing large equipment, are worth the investment (Capital budgeting, 2014

The Term Structure of Introduction Discount Rates and

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

http://www.studymafia.org http://www.studymafia.com4 Introduction Capital Budgeting, broadly defined as a decision-making process that enables managers to evaluate and recognize projects that are valuable to the company, is usually the

Capital Budgeting Definition & Example InvestingAnswers

Capital Budgeting Introduction Synonyms Definition Springer

Capital budgeting techniques A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Evaluation techniques 3. Comparing techniques

2 An Introduction to Capital Budgeting link.springer.com

An Introduction To Capital Budgeting Investopedia

Capital budgeting Introduction and techniques csus.edu

CHAPTER 5. Capital Budgeting. 177 The process of spreading out the cost of a capital asset over the years the asset will be used is . called amortization, a general term that refers to any allocation over a …

Download Capital Budgeting Investment Decisions Pdf Ebook

Capital budgeting Introduction and techniques csus.edu

An Introduction to Capital Budgeting 29 The present value of future income receipts is equal to the sum of the annual cash flows over n years discounted at an interest rate r.

Free Chapter 11 The Basics Of Capital Budgeting PDF

Introduction to Capital Budgeting Techniques lardbucket

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

An Introduction To Capital Budgeting Investopedia

Capital budgeting is the process of figuring out which projects are financially worth an investment. How it works (Example): Let’s assume Company XYZ is deciding whether to purchase a piece of factory equipment for 0,000.

Introduction of Capital Budgeting Accounting Education

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

In the introduction part of capital budgeting, we can explain it as that decisions which are taken for buying long term and fixed assets. Working capital decisions and current assets investment decision do not come under capital budgeting.

Capital Budgeting Part One Introduction And Payback www

Capital Budgeting: Financial Appraisal of Investment Projects Pdf mediafire.com, rapidgator.net, 4shared.com, uploading.com, uploaded.net Download Note: If you’re looking for a free download links of Capital Budgeting: Financial Appraisal of Investment Projects Pdf, epub, docx and …

Capital Budgeting Introduction

Capital Budgeting Introduction. A logical prerequisite to the analysis of investment opportunities is the creation of investment opportunities. Unlike the field of investments, where the analyst more or less takes the investment opportunity set as a given, the field of capital budgeting relies on the work of people in the areas of industrial engineering, research and development, and

Capital Budgeting Introduction Synonyms Definition

The Term Structure of Introduction Discount Rates and

INTRODUCTION TO CAPITAL BUDGETING libvolume1.xyz

Introduction of Capital Budgeting Capital budgeting is the process of identifying, analyzing and selecting investment project by a firm which the project expected will generate cash flows over one year.

Free Chapter 11 The Basics Of Capital Budgeting PDF

View Notes – Chp_5_Capital_Budgeting.pptx from FINANCE 201 at MIT School of Business. CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments. It should add CAPITAL BUDGETING INTRODUCTION Definition: Process of evaluating a companys potential investments.

Capital budgeting Introduction and techniques csus.edu

Download Capital Budgeting Investment Decisions Pdf Ebook

Department of Economics An Introduction to Capital Budgeting Methods Econ 466 Spring, 2010. Chapters 9 and 10

CAPITAL BUDGETING-INTRODUCTION Amazon S3

A SURVEY ON THE EFFECTS OF CAPITAL BUDGETING AND COST

Introduction of Capital Budgeting Accounting Education

42 Y Chapter 9/Cash Flow and Capital Budgeting A sunk cost is a cost that has already been paid and is therefore not recoverable. Cannibalization is the “substitution effect” …

Capital Budgeting Introduction Synonyms Definition

capital budgeting pdf – Oct. 2, 2018 BOE schedules 2020 capital project vote for Dec. 11 At their regular board meeting on Oct. 1, members of the Marcellus Board of Education adopted a resolution to schedule a voter referendum on a proposed capital improvement project for Dec. 11, 2018. Fri, 07 Dec 2018 18:16:00 GMT Capital Project Marcellus School District – The budget of a government is a

Introduction to Capital Budgeting Techniques lardbucket

Capital budgeting Introduction and techniques csus.edu

Capital Budgeting, Steps to capital budgeting, Difference between independent and mutually exclusive projects, Net Present Value (NPV), Internal Rate of Return (IRR) , Comparing the NPV and IRR methods , Calculator Solution for MIRR, Payback period, Multiple IRRs